Which of these statements is not true when you inactivate tasks (available only in Project Professional) in a project?

a. Inactive tasks remain in the task list.

b. You can't edit the values of inactive tasks.

c. Inactive tasks no longer affect the schedule.

d. Project applies different formatting to inactive tasks.

Answers

Answer:

c

Explanation:

It is not true that b. You can't edit the values of inactive tasks when you inactivate tasks.

On Project Professional, you are allowed to inactivate a task. Should you do this:

the task will still remain in the task listit will not however, affect the schedule there will be different formatting for inactive tasksYou will however be able to edit the inactive task as you see fit so it is not true that you can't edit values of inactive tasks.

In conclusion, inactivating a task does not mean that you will not be able to edit its values.

Find out more at https://brainly.com/question/2704239.

Related Questions

purchased goods of rs 40000 journal entries

Answers

The journal entry for Rs. 40, 000 purchases would include a debit to purchases and credit to cash or accounts payable.

How to enter the journal ?The Purchases account is debited because the business has acquired goods, which is an asset. The Accounts Payable account is credited because the business owes money to the supplier for the goods.

Date Account title Debit Credit

XX -XXXX Purchases Rs. 40, 000

Accounts payable Rs. 40, 000

This journal entry will increase the balance of the Purchases account and the Accounts Payable account. The Purchases account will be used to track the cost of goods sold, and the Accounts Payable account will be used to track the amount of money owed to suppliers.

Find out more on journal entries at https://brainly.com/question/30467081

#SPJ1

For the same monopolist firm as in the previous question, what is the price that the monopoly chooses to set to go along with its quantity choice

Answers

Hi, you've asked an incomplete question. However, I provided some explanation about what monopoly entails.

Explanation:

Note that the term monopoly basically refers to a market environment in which an entity or enterprise is the only producer of a particular commodity.

In such a situation, the monopolist firm has a market advantage of being able to choose what price to sell its products without been concerned about the price of the competitor's products.

Freedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $49,000. The machine has an estimated life of five years and an estimated salvage value of $6,600. Required: Calculate the depreciation expense for each year of the asset's life using: Straight-line depreciation. Double-declining-balance depreciation. How much depreciation expense should be recorded by Freedom Co. for its fiscal year ended December 31, 2019, under each method

Answers

Answer:. See explanation

Explanation:

1. The depreciation under the straight line method will be calculated as:

= ( cost - salvage value)/no of years

= (49000 - 6600)/5

= $42400/5

= $8480 per year

2. Using the Double-declining-balance depreciation, the depreciation will be calculated thus:

Double declining rate = 8480/42400 × 2 = 40%

Yr 1: beginning book value = $49000

Depreciation rate = 40%

Depreciation = $49000 × 0.4 = $19600

Ending book value = $29400

Yr 2: beginning book value = $29400

Depreciation rate = 40%

Depreciation = $29400 × 0.4 = $11760

Ending book value = $17640

Yr3: beginning book value = $17640

Depreciation rate = 40%

Depreciation = $17640 × 0.4 = $7056

Ending book value = $10584

Yr4: beginning book value = $10584

Depreciation rate = 40%

Depreciation = $3884 Savage value

Ending book value = $6700

campaigns spend millions of dollars on printing, transportation, media advertising, and other expenses, which explains why many have turned to which of the following to reduce the costs of campaigning?

Answers

The answer is digital media or online platforms. In recent years, many campaigns have turned to social media platforms and online advertising as a way to reach voters and reduce the costs of traditional campaigning methods like print ads, billboards, and television commercials. Digital media offers campaigns the ability to target specific demographics and reach a wider audience at a lower cost than traditional media. Additionally, social media allows candidates to engage directly with voters and receive real-time feedback on their platforms and policies, which can help to inform their campaigns and strategy.

What is the role of fundraising in political campaigns?Fundraising is a critical component of political campaigns, as it provides candidates with the financial resources necessary to run effective campaigns. Donations from individuals and organizations are used to pay for a variety of campaign expenses, including advertising, staff salaries, travel expenses, and polling. Candidates must raise enough money to be competitive in their respective races, and fundraising efforts are often ongoing throughout the campaign cycle. Fundraising success can also be an important indicator of a candidate's viability, as it demonstrates support from voters and other stakeholders. Overall, fundraising is a key aspect of modern political campaigns and plays a significant role in determining election outcomes.

To know more about Digital Media visit:

https://brainly.com/question/28086757

#SPJ1

Many have turned to social media to reduce the costs of campaigning.

What is social media ?

Social media are interactive technologies that facilitate the creation and sharing of information, ideas, interests, and other forms of expression through virtual communities and networks. While challenges to the definition of social media arise due to the variety of stand-alone and built-in social media services currently available, there are some common features.

The term social in regard to media suggests that platforms are user-centric and enable communal activity. As such, social media can be viewed as online facilitators or enhancers of human networks—webs of individuals who enhance social connectivity.

Users usually access social media services through web-based apps on desktops or download services that offer social media functionality to their mobile devices (e.g., smartphones and tablets).

As users engage with these electronic services, they create highly interactive platforms in which individuals, communities, and organizations can share, co-create, discuss, participate, and modify user-generated or self-curated content posted online.

Learn more about Social media

https://brainly.com/question/20246782

#SPJ1

Which of the following best describes the sequences of events that lead to a price increase and quantity

decrease when supply decreases?

Answers

Answer:

you gave no options but according to me

Explanation:

When the demand for a product increases, businesses increase the price while decreasing the supply/quantity.

The office copy machine was always down for repair. As the office manager, Mieko decided to purchase a new photocopier instead of continuing to rent the old machine. She was sure that in the long-run the company would end up saving money by purchasing a new unit. However, Mieko is questioning her decision. She wonders just how much money the company will save and now employees are complaining that the new machine does not have a built-in stapler. Marilyn is experiencing:___________.

Answers

Incomplete question; lacks options. However, I answered from a general perspective.

Answer:

regret of purchase

Explanation:

It is noteworthy that Mieko made a purchase of the photocopier without giving much thought to the action.

Since it appears the new machine lacks a built-in stapler, it seems they may still need to rent staplers, which would thus constute part of the company's cost in the long run.

Hence, Mieko is experiencing a regret of her purchase.

Calculating Cost of Debt For the firm in the previous problem, suppose the book value of the debt issue is $35 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 12 years left to maturity; the book value of this issue is $80 million and the bonds sell for 61 percent of par. What is the company’s total book value of debt? The total market value? What is your best estimate of the aftertax cost of debt now?

Answers

The best estimate of the aftertax cost of debt for the firm is 3.47% in the given case.

To calculate the total book value of debt, we sum the book values of both debt issues:

Total book value of debt = Book value of debt issue 1 + Book value of debt issue 2

Total book value of debt = $35 million + $80 million

Total book value of debt = $115 million

To calculate the market value of the zero coupon bond, we need to find 61% of the face value:

Market value of zero coupon bond = 0.61 x Face value of zero coupon bond

Market value of zero coupon bond = 0.61 x $80 million

Market value of zero coupon bond = $48.8 million

The total market value of debt is the sum of the market values of both debt issues:

Total market value of debt = Market value of debt issue 1 + Market value of debt issue 2

Total market value of debt = $35 million + $48.8 million

Total market value of debt = $83.8 million

To find the aftertax cost of debt, we need to first calculate the yield to maturity on the zero coupon bond. We know that the bond has 12 years left to maturity and sells for 61% of par, so we can use the following formula to find the yield to maturity:

61% of face value = $48.8 million

Par value = $100 million

Years to maturity = 12

Yield to maturity = ?

Solving for the yield to maturity using a financial calculator or spreadsheet, we get:

Yield to maturity = 4.83%

Next, we need to find the aftertax cost of debt for both debt issues separately and then weight them by their respective market values. We are given that the company's tax rate is 40%.

For the first debt issue, we are given that the coupon rate is 8% and that the bonds are currently selling at par, so the beforetax cost of debt is 8%. The aftertax cost of debt is:

Aftertax cost of debt issue 1 = Beforetax cost of debt issue 1 x (1 - Tax rate)

Aftertax cost of debt issue 1 = 8% x (1 - 40%)

Aftertax cost of debt issue 1 = 4.8%

For the zero coupon bond, we already calculated the yield to maturity, which is the beforetax cost of debt. The aftertax cost of debt is:

Aftertax cost of debt issue 2 = Beforetax cost of debt issue 2 x (1 - Tax rate)

Aftertax cost of debt issue 2 = 4.83% x (1 - 40%)

Aftertax cost of debt issue 2 = 2.90%

Finally, we can weight the aftertax costs of debt by their respective market values to get the overall aftertax cost of debt:

Overall aftertax cost of debt = (Market value of debt issue 1 / Total market value of debt) x Aftertax cost of debt issue 1 + (Market value of debt issue 2 / Total market value of debt) x Aftertax cost of debt issue 2

Plugging in the numbers, we get:

Overall aftertax cost of debt = ($35 million / $83.8 million) x 4.8% + ($48.8 million / $83.8 million) x 2.90%

Overall aftertax cost of debt = 3.47%

To know more about debt here

https://brainly.com/question/1957305

#SPJ1

10. What happens during a bank run?

The price of gold suddenly increases, which devalues bank deposits.

States charter more banks than needed.

The government orders a bank to close.

Customers attempt to withdraw more money than the bank has on hand.

Answers

The thing which happens during a bank run is:

Customers attempt to withdraw more money than the bank has on hand.What is a Bank Run?This refers to the mass withdrawal of funds by a large number of customers where the banks are unable to pay everyone because they do not have the capacity to make such large withdrawals.

With this in mind, we can see that during a bank run, the main thing which pushes people is the fear of insolvency so that they would not lose their money.

Read more about bank run here:

https://brainly.com/question/10550250

meaning of hazard in risk management and examples

Answers

Answer: Identifying Hazards Means Identifying Sources of Risks

Explanation:

A hazard is basiclly something that could harm something else or someone.

So it’s basically now adverse affect

example; to people as health effects, to organizations as property or equipment losses, or to the environment).

I really hope this will help I’m sorry if I didn’t say what you wanted but there you go. (:

1. A requested task is subject to be reported when:

Requesting for a screenshot

When it is asking for 3 proofs

When it requests for email address to be submitted

The task requested promote violent and/or illegal activities

Answers

A requested task is subject to be reported when it promotes violent and/or illegal activities. This ensures that any content or actions that pose a threat or violate the law are appropriately addressed and handled. Reporting such tasks helps maintain a safe and secure environment for users and prevents the dissemination of harmful or unlawful content.

Promoting violent and/or illegal activities goes against community guidelines and ethical standards. By reporting such tasks, users can play an active role in upholding the rules and regulations of the platform or community they are a part of. Reporting serves as a mechanism for users to flag content or requests that could potentially harm individuals or society as a whole.

Requesting for a screenshot, asking for three proofs, or requesting an email address submission, on their own, may not necessarily warrant a report. These actions typically serve functional or practical purposes in various contexts. However, it is essential to assess the overall intent and impact of a requested task to determine whether it aligns with ethical standards and legal requirements. If a task requests actions that are potentially harmful or against the rules, it should be reported to the appropriate authorities or platform administrators for further investigation and appropriate action.

For more such answers on requested task

https://brainly.com/question/30042698

#SPJ8

The initial cash outlay of a project is X is Rs 100,000 and it can generate cash inflow of Rs 40,000, Rs 30,000, Rs 50,000 and Rs 20,000 in year 1 through 4. Assume a 10 per cent rate of discount. Assume that a project Y requires an outlay of Rs 50,000 and yields annual cash inflow of Rs 12,500 for 7 years at the rate of 12%.

Answers

On the net present value analysis, project Y is expected to generate a higher return on investment compared to project X.

To evaluate the two projects, X and Y, we will calculate their net present value (NPV) using the given cash inflows, discount rate, and initial cash outlay.

For project X:

The cash inflows for each year are Rs 40,000, Rs 30,000, Rs 50,000, and Rs 20,000 for years 1 through 4, respectively.

The initial cash outlay is Rs 100,000.

The discount rate is 10%.

To calculate the NPV, we discount each cash inflow to its present value using the discount rate and subtract the initial cash outlay:

NPV(X) = (40,000 / (1 + 0.10)^1) + (30,000 / (1 + 0.10)^2) + (50,000 / (1 + 0.10)^3) + (20,000 / (1 + 0.10)^4) - 100,000

Simplifying the calculations:

NPV(X) = 36,363 + 24,793 + 34,979 + 13,167 - 100,000

= 9,302

The net present value (NPV) for project X is Rs 9,302.

For project Y:

The cash inflow for each year is Rs 12,500 for 7 years.

The initial cash outlay is Rs 50,000.

The discount rate is 12%.

Using the same formula as above, we calculate the NPV for project Y:

NPV(Y) = (12,500 / (1 + 0.12)^1) + (12,500 / (1 + 0.12)^2) + ... + (12,500 / (1 + 0.12)^7) - 50,000

Simplifying the calculations:

NPV(Y) = 11,161 + 9,960 + 8,888 + ... + 3,637 - 50,000

= 11,042

The net present value (NPV) for project Y is Rs 11,042.

For more such question on investment. visit :

https://brainly.com/question/29547577

#SPJ8

The task of crafting a strategy is

А

the function and responsibility of a few high-level executives

B

more of a collaborative group effort that involves all managers and sometimes key employees striving

to arrive at a consensus on what the overall best strategy should be

С

the function and responsibility of a company's strategic planning staff

D

a job for a company's whole management team - senior executives plus the managers of business

units, operating divisions, functional departments, manufacturing plants, and sales districts

Record Answer

You must select an answer and press "Record Answer" for your answer to be recorded. DO NOT let the time expire for the question you are on.

If this happens before you answer a question, the exam will automatically advance to the next question and you will not get credit for the

Answers

Raphael lives in San Diego and runs a business that sells guitars. In an average year, he receives $724,000 from selling guitars. Of this sales revenue, he must pay the manufacturer a wholesale cost of $424,000; he also pays wages and utility bills totaling $266,000. He owns his showroom; if he chooses to rent it out, he will receive $4,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Raphael does not operate this guitar business, he can work as a paralegal, receive an annual salary of $21,000 with no additional monetary costs, and rent out his showroom at the $4,000 per year rate. No other costs are incurred in running this guitar business.Identify each of Raphael's costs in the following table as either an implicit cost or an explicit cost of selling guitars. Implicit Cost 0 Explicit Cost 0 a.The rental income Raphael could receive if he chose to rent out his showroom b.The wholesale cost for the guitars that Raphael pays the manufacturer c.The salary Raphael could earn if he worked as a paralegal d.The wages and utility bills that Raphael pays Complete the following table by determining Raphael's accounting and economic profit of his guitar business. Profit (Dollars) Accounting Profit Economic Profit Alternatively, the economic profit he would earn as a paralegal would be $? If Raphael's goal is to maximize his economic profit, he stay in the guitar business. True or false: Raphael is not earning a normal profit because his profit is positive. a.False b.True

Answers

Accounting profit is $34,000. Economic profit is - $7,000. Explicit cost are cost incurred in the course of running a business.

What is Explicit cost?Explicit costs are regular business expenses that are recorded in the general ledger of a firm and have a direct impact on its profitability. They have specific monetary values that are carried over to the income statement.

Wages, leasing payments, utilities, raw materials, and other direct costs are a few examples of explicit costs. Only explicit costs are taken into account when determining a company's profit because they clearly have an impact on its bottom line.

Depreciation is an explicit cost even if it cannot be directly linked to the cost of the underlying corporate asset because it cannot be physically traceable. The residual income that is left over after all explicit costs have been covered by a business's net income (NI).

Learn more about Explicit cost, here

https://brainly.com/question/27042286

#SPJ9

Suppose Simone is a sports fan and buys only baseball caps. Simone deposits $2,000 in a bank account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed—that is, it won't change over time. At the time of her deposit, a baseball cap is priced at $10.00.

Initially, the purchasing power of Simone's $2,000 deposit is baseball caps.

For each of the annual inflation rates given in the following table, first determine the new price of a baseball cap, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Simone's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates.

Hint: Round your answers in the first row down to the nearest baseball cap. For example, if you find that the deposit will cover 20.7 baseball caps, you would round the purchasing power down to 20 baseball caps under the assumption that Simone will not buy seven-tenths of a baseball cap.

Annual Inflation Rate

0%

10%

13%

Number of Caps Simone Can Purchase after One Year Real Interest Rate When the rate of inflation is less than the interest rate on Simone deposit, the purchasing power of her deposit (Rises,falls or remains the same )over the course of the year.

Answers

The nominal interest rate and real interest rate are same. This is due to the fact that the rate of inflation is the only distinction between the real interest rate and the nominal interest rate. Because there is no inflation, both the nominal and real interest rates are the same.

when interest rates are higher than inflation rates?When the interest rate on a loan is 2 percent and inflation is 3 percent, the lender's after-inflation return is less than zero. As a result, we state that the real interest rate—defined as the nominal rate less the rate of inflation—is negative.

Why do nominal interest rates go up as inflation goes up?This is due to the fact that inflation reduces the actual worth of the money that will be returned at the conclusion of the loan period, causing the real (inflation-adjusted) rate of interest to be lower than the nominal rate.

To Know more about nominal interest

https://brainly.com/question/13324776

#SPJ4

[insert your responses to the following: explain the intent of the taxation policy decisions you made of your seven-year term. what were the macroeconomic principles or models that influenced your decision making?]

Answers

The goal of taxation should be to raise the revenue needed to meet the government's spending requirements while not distorting economic decision-making or discouraging all Americans from spending, saving, and investing.

What is taxation?The notions that humans respond emotionally to economic situations, as well as through "multiplier effects" that complicate the outcomes, are among the macroeconomic principles that influence taxation policy decision-making.Taxation is the process by which a government raises funds to spend on things like public services and welfare benefits. There are numerous methods for obtaining tax revenue, as well as various definitions and structures for taxation.Taxation is the inherent power by which the sovereign, through its legislative body, raises revenue to cover the government's necessary expenses. It is a method of allocating the costs of the government among those who are privileged to enjoy its benefits while also bearing its burdens.To learn more about taxation refer to :

https://brainly.com/question/1133253

#SPJ4

Quality Ceramic, Inc. (QCI) defined five submarkets within its broad product-market. To obtain some economies of scale, QCI decided not to offer each of the submarkets a different marketing mix. Instead, it selected two submarkets whose needs are fairly similar, and is counting on promotion and minor product differences to make its one basic marketing mix appeal to both submarkets. QCI is using the

Answers

Answer:

combined target market approach

Explanation:

When a company engages in a combined target market approach, it segregates potential markets into pairs or small groups which share similarities and then offers their products or services to them. The marketing mix will be similar for all the small segments that are within the larger group.

What is the answer i been trying this whole time.If you get it i'll give you 30 point honestly......

Answers

Answer:

GBGGPGGGGRGGGGGPGGGWG

Explanation:

Green trees = G

Blue trees = B

Pink trees = P

Red trees = R

Purple trees = P

White trees = W

The department chain you work for has had numerous complaints about slow customer service.

Your colleague, a sales manager, informs you that this happened at a previous store she worked for,

and it was cleared up by hiring more sales representatives. Should you take her advice to solve this

problem? Why or why not? What techniques can you use in evaluating the problem?

Answers

Answer:

The advice should not be taken, as it is a rush to judgement, which could mean that the wrong solution is used, wasting time and resources. You should ask the colleague to employ critical thinking. Critical thinking is sustained suspension of judgement with an awareness of multiple perspectives and alternatives. It involves at least four elements:

•Maintaining doubt and suspending judgement

•Being aware of different perspectives

•Testing alternatives and letting experience guide

•Being aware of organizational and personal limitations

What are the factors of production?

Answers

Answer:

Human, natural, and capital resources are used to make products to be sold.

Explanation:

on edge 2022

Summarize chaleff’s courageous followership? I need help!!

Answers

Chaleff's courageous followership emphasizes the importance of active and engaged followers who possess the courage to speak up, take initiative, act ethically, and influence their leaders and organizations positively.

Chaleff's courageous followership is a concept that highlights the significance of followers who possess the courage and willingness to actively engage in their roles and influence their leaders and organizations in a positive manner. It challenges the traditional notion that followers should simply obey and conform to their leaders without question.

According to Chaleff, courageous followership involves followers who are willing to speak up, take initiative, and provide constructive feedback to their leaders. These followers are not afraid to express their opinions, voice concerns, and offer alternative viewpoints, even when it goes against the prevailing norms or authority. They understand that their active participation is crucial for the success and growth of the organization.

Courageous followers also exhibit ethical behavior and take responsibility for their actions. They hold themselves accountable for their decisions and actions, aligning their behaviors with their values and the organization's values. They are willing to stand up against unethical practices and unethical leadership when necessary, with the aim of promoting integrity and ethical decision-making within the organization.

Chaleff's courageous followership promotes a collaborative and mutually beneficial relationship between leaders and followers. It encourages leaders to create an environment where followers feel safe and empowered to express their ideas and concerns. By fostering open communication and embracing diverse perspectives, leaders can tap into the full potential of their followers and create a culture of innovation and adaptability.

In summary, Chaleff's courageous followership emphasizes the importance of active and engaged followers who possess the courage to speak up, take initiative, act ethically, and influence their leaders and organizations positively. It advocates for a dynamic and collaborative relationship between leaders and followers, ultimately aiming to enhance organizational effectiveness, ethical decision-making, and overall success.

for more such questions on leaders

https://brainly.com/question/29762998

#SPJ11

What is one disadvantage of buying stocks?

A. Stocks are private and difficult to purchase.

B. Stocks are a high-risk investment.

C. Stocks are low-risk but have a low rate of return.

D. Stocks don't pay out until you reach a specific age.

SUBMIT

Answers

Answer:

B. Stocks are a high-risk investment.

Explanation:

B. Stocks are a high-risk investment. This is one disadvantage of buying stocks. The stock market can be volatile, and there is always a risk of losing money, especially if an investor invests in a single company or industry and that company or industry experiences significant losses or downturns. It is important to have a diversified portfolio to mitigate some of this risk.

Which of the following is recorded in a country’s balance of payments accounts?

Answers

Answer:

Considering there are no options to pick from, the following accounts are recorded in a country’s balance of payments accounts:

1. the current account

2. the capital account

3. the financial account.

Explanation:

Therefore;

1. The current account is part of the country’s balance of payments accounts to define the inflow and outflow of goods and services into a particular country.

2. The capital account is also a country’s balance of payments account that documents all the international capital transfers of a country.

3. The financial account is part of the country’s balance of payments accounts where the international monetary flows concerning the investment in the business, real estate, bonds, and stocks are fully recordsd.

Matrix management creates an environment in which the unity-of-command principle is strictly followed. is a collection of independent, mostly single-function firms that collaborate to produce a good or service. is composed of dual reporting relationships in which some employees report to two superiors. involves holding employees together by contracts that stipulate results expected, rather than by hierarchy and authority. results in a centralized decision-making system.

Answers

Answer:

Matrix management

is composed of dual reporting relationships in which some employees report to two superiors.

Explanation:

Matrix management is a cross-functional work team in which there is dual or multiple management accountability and responsibility. Team members come from different units to achieve a specific business goal or purpose. It is characterized by two chains of command. One chain of command is functional, and the other chain of command is patterned along project, product, client, and other lines.

When the actual cost of direct materials used exceeds the standard cost, the company must have experienced an unfavorable direct materials price variance.

a. True

b. False

Answers

Answer:

True

Explanation:

The cost was bigger than they had budgeted for, so it was an unfavorable variance.

What should be considered before speaking, so there is not a context error in the communication. Choose three answers.

Question 2 options:

Location

Gender

Environment

Time

Answers

Gender, Location, and Time are the phenomenon that should be considered before speaking, so there is not a context error in the communication. Therefore, the options A, B and D hold true.

What is the significance of communication?Communication can be referred to or considered as the process of formation of an interaction between two or more people. A communication is surrounded by a number of aspects such as gender(s) involved in interaction, the time, and location at which it takes place.

Therefore, the options A, B and D hold true and state regarding the significance of communication.

Learn more about communication here:

https://brainly.com/question/22558440

#SPJ1

Answer:

location, gender, and time

Explanation:

i took the test

time in line to buy groceries

Answers

help with the blank lol

Answers

Question Content Area

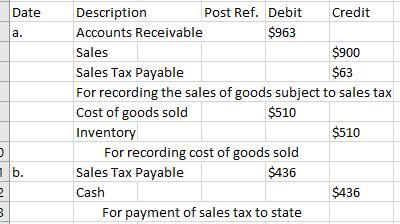

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

Claire and Evelyn have an argument over the timing of the charity event at an orphanage organized by their manager. Claire wants the timing to be 8:00 am while Evelyn wants the timing to be 9:00 am as the place is a bit far from her home. The manager intervenes and asks them to understand each other’s concern. They finally agree to the solution that the timing for the event could be 8:30 am and the manager would pick both of them from convenient spots. Which method of conflict resolution does the situation reflect?

MULTIPLE CHOICE

A.

competing

B.

avoidance

C.

collaboration

D.

smoothing over the problem

E.

compromise

Answers

The method of conflict resolution that the situation reflects is compromise. In compromise, both parties give up something in order to reach a mutually agreeable solution. In this case, Claire and Evelyn both gave up their preferred timing in order to arrive at a compromise of 8:30 am. The manager also played a role in the compromise by offering to pick both of them up from convenient spots.

The other options are not correct. Competing is a conflict resolution method in which one party tries to get their way at the expense of the other party. Avoidance is a conflict resolution method in which one party tries to avoid dealing with the conflict altogether. Collaboration is a conflict resolution method in which both parties work together to find a solution that meets the needs of both parties. Smoothing over the problem is a conflict resolution method in which one party tries to make the other party feel better about the conflict, even if the problem is not actually resolved.

Both corrective taxes and tradable pollution permits reduce the cost of environmental protection and thus should increase the public's demand for a clean environment. b. Both corrective taxes and tradable pollution permits provide market-based incentives for firms to reduce pollution. c. Tradable pollution permits have an advantage over corrective taxes if the government is uncertain as to the optimal size of the tax necessary to reduce pollution to a specific level. d. Corrective taxes set the maximum quantity of pollution, whereas tradable pollution permits fix the price of pollution.

Answers

Answer:

d. Corrective taxes set the maximum quantity of pollution, whereas tradable pollution permits fix the price of pollution.

Explanation:

The government applied the alternatives for the policy in order to control the pollution problem

here following two vital policy alternatives i.e.

1. Corrective taxes

2. Permits of Tradable pollution

The corrective taxes impose the per unit tax with regard to the pollution i.e. emitted. Also it fixed the pollution price

Here there is a permit of the tradable pollution that could set the pollution limit i.e. maximum. On the other hand, the firm could emit the pollution till the quantity mentioned by the permit of the tradable permit

So, the option d should be considered