TB MC Qu. 18-81 (Algo) C. Worthy Ships initially issued... C. Worthy Ships initially issued 490,000 shares of $1 par stock for $2,450,000 in 2021. In 2023, the company repurchased 49,000 shares for $490,000. In 2024, 24,500 of the repurchased shares were resold for $392,000. In its balance sheet dated December 31, 2024, C. Worthy's treasury stock account shows a balance of:_____.

Answers

Answer:

$245,000

Explanation:

Calculation for what Worthy's treasury stock

Account Balance will show

Based on the information given the year 2023 treasury stock repurchase that was made will be debited with the amount of $490,000 and Since we were told that half of the treasury stock was resold the amount of $245,000 (490,000*50%) will be credited to treasury stock while the amount of $147,000 ($392,000-$245,000) will be credited to Paid-in capital share repurchase

Treasury stock account balance=($490,000 - $245,000)

Treasury stock account balance=$245,000

Therefore C. Worthy's treasury stock account shows a balance of: $245,000

Related Questions

Assume that you and your classmates are board members of a child care and education center for 60 preschool children located in a community center building. They had asked you to set up the program four years ago. Now the community center director feels he needs your space for additional adult activities during the day. You need to move out of the building in 30 days. What will you do? Consider all the options, and then make a plan.

Answers

The best plan for you would be to write to the education board regarding the issues that you are facing.

What are the functions of the local education board?The education board in a local area can help to do the following

Employ a school superintendentdevelop school policiesDevelop curriculumTake care of all issues that have to do with facilities.Hence the best thing would be to let them know of the issues you are facing in order to determine the best help necessary.

Read more on education board here:

https://brainly.com/question/27049030

#SPJ1

Dale is a guitar teacher and Terrence is a tile layer. If Dale teaches Terrence's daughter to play the guitar in

exchange for Terrence tiling Dale's kitchen floor,

a. only Dale is made better off by trade.

O b. both Dale and Terrence are made better off by trade.

c. neither Dale nor Terrence are made better off by trade.

O d. only Terrence is made better off by trade.

Answers

If Dale teaches Terrence's daughter to play the guitar in exchange for Terrence tiling Dale's kitchen floor Option B. both Dale and Terrence are made better off by trade.

In this scenario, Dale is a guitar teacher and Terrence is a tile layer. Dale teaches Terrence's daughter how to play the guitar in return for Terrence tiling Dale's kitchen floor. It is a classic example of trade and bartering. Dale, the guitar teacher, would have had to pay for tile installation if he hadn't bartered with Terrence, the tile layer. Terrence, on the other hand, would have had to pay for guitar lessons if he hadn't traded with Dale.

Both Dale and Terrence, therefore, benefit from the trade, and they are both better off as a result. Because Dale receives tile installation in exchange for teaching guitar lessons, and Terrence receives guitar lessons in exchange for tile installation, both benefit.

In conclusion, the answer is (b) both Dale and Terrence are made better off by trade. When both parties are better off after a trade, it is known as a mutually beneficial trade. Trade, in general, promotes mutual gains by allowing people to concentrate on what they do best and exchange their output with others for goods and services that they desire. Therefore, the correct option is B.

Know more about Trade here:

https://brainly.com/question/24431310

#SPJ8

Mark Brandt, an employee of Mueller Corp., earned 3 weeks of compensated vacation time during the current year, but only took 2 weeks of vacation. His employer permits that 1 week of vacation can be carried forward to the following year. Mark fully intends to remain at his current employer and plans to take his vacation during the following year. His current weekly salary is $2,000. Mueller Corp. expects to grant a general salary increase of 5% effective at the beginning of the next year. What amount should Mueller accrue during the current year relating to Mark Brandt's carried-forward vacation

Answers

Answer:

Mark Brandt of Mueller Corporation

The amount that Mueller should accrue during the current year relating to Mark Brandt's carried-forward vacation is:

= $2,100

Explanation:

a) Data and Calculations:

Current weekly salary = $2,000

Expected general salary increase = 5%

The amount that Mueller should accrue during the current year relating to Mark Brandt's carried-forward vacation is:

= $2,000 * 1.05

= $2,100

b) $2,100 is the amount that will be paid in cash for cash settlement of Mark Brandt's carried-forward vacation, assuming he does not take it the following year.

1. Which class of medications does the Centers for Medicare and Medicaid Services limit the PRN use to 14 days?

Anticholinergics

Antipsychotic medications

Antiarrhythmics

Beta-blockers

Answers

The Centers for Medicare and Medicaid Services limit PRN use to 14 days for Antipsychotic medications.

PRN prescription and administration are generally used for psychotropic and psycholeptics medications, including antipsychotics, neuroleptics, anxiolytics, sedatives, and hypnotics.

PRN antipsychotic orders are restrained to 14 days simplest. PRN antipsychotic orders might not be extended past the 14-day restriction. documents the scientific purpose for the brand new order, which ought to consist of how the resident benefits from the medication as a result of the PRN order.

The PRN prescription stands for 'pro re nata,' which means that the management of medication is not scheduled. as a substitute, the prescription is taken as wished.

Learn more about PRN here https://brainly.com/question/17531709

#SPJ9

Identify whether or not each of the following scenarios describes a competitive market, along with the correct explanation of why or why not.

a. In a small town, there are two providers of broadband Internet access: a cable company and the phone company. The Internet access offered by both providers is of the same speed.

b. The government has granted a patent to a pharmaceutical company for an experimental AIDS drug. That company is the only firm permitted to sell the drug.

c. Dozens of companies produce plain white socks. Consumers regard plain white socks as identical and don't care who manufactures their socks.

d. In a major metropolitan area, one chain of coffee shops has gained a large market share because customers feel its coffee tastes better than that of its competitors.

Answers

Answer:

1. not a competitive market

2. not a competitive market

3. competitive market

4. not a perfectly competitive market

Explanation:

To answer this question, i will first start by explaining what a competitive market is and the assumption of a perfectly competitive market as well

A competitive market is a market that has many producers and buyers of a particular product. The producers are usually in a competition to meet up with the needs of the buyers.

some assumptions of the market:

large sellers/producersidentical or homogenous goodsfree entryno discriminationperfect knowledgea. in this question this is not a competitive market. the reason is simple. It says that there are only two providers of internet. So there are no enough producers or sellers

b. The government has limited entry into this market by giving patent to only one pharmaceutical company.

c. yes this market is competitive since there are many producers of the product and the consumers regard the products as identical or homogenous. this meets with all of the assumptions of a perfectly competitive market.

d. the product here is not homogenous or identical as this is not a perfectly competitive market since buyers would prefer to buy the coffee that tastes better and leave that of the competitors

thank!

Example of a market for a good or service that is not rely on a physical store or location

Answers

An example of a market for a good or service that does not rely on a physical store or location is the online marketplace. With the advent of the internet and e-commerce platforms, businesses and individuals can sell products and services entirely online without the need for a brick-and-mortar store.

Online marketplaces, such as Amazon, eBay, and Alibaba, provide a platform where buyers and sellers can connect and conduct transactions electronically. These platforms enable businesses to showcase their products, provide detailed descriptions, and facilitate secure online payments. Customers can browse through a wide range of products, compare prices, read reviews, and make purchases from the comfort of their own homes.

The online marketplace has revolutionized various industries, including retail, entertainment, travel, and professional services. It allows businesses to reach a global customer base, operate 24/7, and reduce overhead costs associated with physical stores. Additionally, it provides convenience for consumers, who can shop anytime, anywhere, and have products delivered to their doorstep.

Overall, the online marketplace has transformed the way goods and services are bought and sold, offering a virtual alternative to traditional physical stores and locations.

Know more about good or service here:

https://brainly.com/question/25262030

#SPJ8

A business owner is aware that the Department of Labor has created rules

that require overtime pay for employees. When he works his employees more

than 40 hours in one week, he makes sure that he works them less than 40

hours the following week. The business owner feels that it is fair to average

the number of hours worked over the two weeks covered by the pay period

and use that number for calculating overtime pay. A representative of the

Department of Labor informs him that their regulations do not permit this,

Which of the following is true in this situation?

Answers

Answer:

the buisness owner must comply to the department of labor regulations

Explanation:

Interventions strategies to prevent restrictions or barrier in small businesses townships

Answers

To prevent restrictions or barriers in small businesses in townships, several intervention strategies can be implemented:

1. Business Development Support: Offer training programs, workshops, and mentorship opportunities to help small business owners develop essential skills such as financial management, marketing, and business planning.

2. Access to Capital: Establish microfinance programs or low-interest loan schemes to provide small businesses with the necessary funds to start or expand their operations. Additionally, create partnerships with financial institutions to streamline the loan application process.

3. Infrastructure Improvement: Invest in upgrading township infrastructure, including roads, electricity, and internet connectivity. This will enhance the business environment, attract investors, and facilitate smoother operations for small businesses.

4. Regulatory Simplification: Simplify and streamline licensing and permit procedures, reducing bureaucracy and paperwork burdens. This will make it easier for entrepreneurs to start and operate businesses, fostering a favorable environment for small enterprises.

5. Market Linkages: Facilitate connections between small businesses and larger supply chains, enabling them to access wider markets and secure stable customer bases. This can be achieved through networking events, trade fairs, and partnerships with established businesses.

6. Local Procurement Policies: Encourage local governments and institutions to adopt procurement policies that prioritize purchasing goods and services from small businesses in the townships, thereby boosting their economic growth and sustainability.

7. Collaborative Initiatives: Foster collaboration among small businesses by establishing business associations, cooperatives, or incubation centers. These platforms can provide shared resources, collective marketing efforts, and a supportive community.

By implementing these intervention strategies, the barriers and restrictions faced by small businesses in townships can be minimized, promoting their growth, sustainability, and contribution to the local economy.

For more questions on Capital, click on:

https://brainly.com/question/15300072

#SPJ8

In which of the following instances would the deadweight loss on the tax of airline tickets increase by a factor of nine?

A The tax on airline tickets increases from $15 per ticket $60 per ticket

B The tax on airline tickets increase from $20 per ticket to $90 per ticket

C the tax on airline tickets increased from $15 per ticket to $135 per ticket

D the tax on airline tickets increase from $20 per ticket to $60 per ticket

Answers

The deadweight loss is going to have to happen when the tax on airline tickets increase from $20 per ticket to $60 per ticket. Option D.

What is meant by deadweight loss?The loss of overall welfare or the social surplus as a result of factors such as taxes or subsidies, price ceilings or floors, externalities, and monopoly pricing is known as "deadweight loss."

The cost of market inefficiency, which happens when supply and demand are out of balance, is known as a deadweight loss. Deadweight loss, a term mostly used in economics, refers to any deficit brought on by an ineffective resource allocation.

Read more on deadweight loss here: https://brainly.com/question/15415492

#SPJ1

These financial statement items are for Fairview Corporation at year-end, July 31, 2022.

Salaries and wages payable $ 2080

Salaries and wages expense 57,500

Supplies Expense 15,600

Equipment 18,500

Accounts payable 4,100

Service Revenue 66, 100

Rent expense 8,500

Notes payable(due in 2025) 1,800

Common Stock 16,000

Cash 29,200

Accounts Receivable 9,780

Accumulated depreciation-equipment 6,000

Dividends 4,000

Depreciation expense 4,000

Retained earnings (beginning of the year) 34,000

a. Prepare an income statement and a retained earnings statemeny for the year. Fairview Corporation did not issue any new stock during the year.

b. Prepare a classified balance sheet at July 31.

c, Compute the current ratio and debt to assets ratio

d. Suppose that you are president of Lunar Equipment. Your sales manager has approached you with a proposal to sell $ 20,000 of equipment to Fairview. He would like to provide a loan to Fairview in the form of a 10%, 5-year note payable. Evaluate how this loan would charge Fairview's current ratio, and discuss whether you would make the sale.

Answers

a) The preparation of the income statement and the retained earnings statement for the year for Fairview Corporation is as follows:

Fairview Corporation

Income StatementFor the year ended July 31,

Service Revenue $66, 100

Salaries and wages expense 57,500

Supplies Expense 15,600

Rent expense 8,500

Depreciation expense 4,000 $85,600

Net loss ($19,500)

Fairview Corporation

Retained Earnings StatementFor the year ended July 31,

Beginning balance $34,000

Net loss ($19,500)

Dividends (4,000)

Ending balance $10,500

b) The preparation of a classified balance sheet for Fairview Corporation at July 31 is as follows:

Fairview Corporation

Balance SheetAssets

Current Assets:

Cash $29,200

Accounts Receivable 9,780

Total current assets $38,980

Long-term assets:

Equipment $18,500

Accumulated depreciation 6,000 $12,500

Total assets $51,480

Liabilities and Equity

Current liabilities:

Accounts payable $4,100

Salaries and wages payable 2,080 $6,180

Long-term liabilities:

Notes payable(due in 2025) 18,800

Total liabilities $24,980

Common Stock $16,000

Retained earnings 10,500

Total equity $26,500

Total liabilities and equity $51,480

c). The current ratio and debt to assets ratio are as follows:

Current ratio = current assets/current liabilities

= 6.3 ($38,980/$6,180)

Debt to assets ratio = total liabilities/total assets

= 48.5% ($24,980/$51,480 x 100)

d) The current ratio would not change as a result of the proposed $20,000 loan.

The decision to grant the loan depends on many economic factors, including demand and supply (the possibility of selling) of the equipment to another customer and collecting cash, together with the prevailing interest rate.

Data and Calculations:Cash 29,200

Accounts Receivable 9,780

Equipment 18,500

Accumulated depreciation-equipment 6,000

Accounts payable 4,100

Salaries and wages payable $ 2080

Notes payable(due in 2025) 18,800

Common Stock 16,000

Retained earnings (beginning of the year) 34,000

Dividends 4,000

Service Revenue 66, 100

Salaries and wages expense 57,500

Supplies Expense 15,600

Rent expense 8,500

Depreciation expense 4,000

Learn more about preparing financial statements at https://brainly.com/question/26240841

#SPJ1

Your friend Jenny says a Roth IRA has the best tax advantages, because you pay taxes now and won’t have to pay them when you take the money out in retirement. Why might she be right?

Answers

Jenny might be right if the taxes are expected to rise.

What is the Internal Revenue Service?This refers to the United States federal agency that is tasked with the collection of taxes and implementation of federal tax laws.

Hence, we can see that based on the advice by Jenny about the use of Roth IRA because of its best tax advantages where she can pay taxes now and won’t have to pay them when you take the money out in retirement, this is good advice, only if the taxes are expected to rise.

Read more about taxes here:

https://brainly.com/question/26316390

#SPJ1

Which of the following requests below require data mining techniques rather than traditional database techniques.

1. Identify all shoppers who bought dog food last week.

2. Identify items that tend to be purchased by common shoppers.

3. Identify any correlation between time-of-day and items purchased.

4. Identify the items purchased during the first hour after opening the store.

3

2 3 4

2 3

1 2 3

Answers

The requests which require data mining techniques rather than traditional database techniques are: identify items that tend to be purchased by common shoppers; and, identify any correlation between time-of-day and items purchased. The correct answers are option 2 and 3.

What are data mining techniques?Data mining is the process of analyzing dense volumes of data to explore patterns, find trends, and gain insight into how that data can be used. Data miners can then use those findings to make decisions or predict an outcome.

Data mining techniques include Classification, Clustering, Regression, Association rules, Outer detection, Sequential Patterns, and Prediction. Classification data mining techniques involve analyzing the various attributes associated with different types of data.

Once organizations identify the main characteristics of these data types, organizations can categorize or classify related data. Data mining technique helps organizations to get knowledge-based information.

Learn more about data mining techniques at: https://brainly.com/question/4129232

#SPJ4

What is a marginal tax rate?

the actual percentage of federal tax paid

the highest percentage of federal tax paid

the lowest percentage of federal tax paid

the rate difference between joint and single filers

Answers

Answer:

the highest percentage of federal tax paid

Explanation:

The marginal tax rate implies the highest tax rate applicable in a progressive tax system. It is the tax rate imposed on extra income. In a progressive tax system like the one used in the US, the tax rate rises as income increases. The marginal tax rate is the increased tax rate paid on the extra dollar earned.

The marginal tax rate is, therefore, the highest percentage of federal tax paid.

Inventory items received should be compared against: Multiple Choice Sales receipt Purchase order Sales order Supplies inventory

Answers

Answer:

Purchase order

Explanation:

To verify existence and accuracy of inventory items received, the receiving division must compare the quantities, amounts and descriptions of the items received against the Purchase order.

International Gems sells fine jewelry and has implemented activity-based costing. Costs in the shipping department have been divided into three cost pools. The first cost pool contains costs that are related to packaging and shipping. International has determined that the number of boxes shipped is an appropriate cost driver for these costs. The second cost pool is made up of costs related to the final inspection of each item before it is shipped and the cost driver for this pool is the number of individual items that are inspected. The final cost pool is used for general operations of the department and the cost driver is the number of orders. Information about the activities is summarized below:

Cost Pool Estimated Total Costs Cost Driver Estimated Annual Activity

Packaging and shipping 67,200 Number of boxes shipped 16,000 boxes

Final inspection 200,000 Number of individual items inspected 100,000 items

General operations 85,000 Number of orders 10,000 orders

During the period, the Southern sales office generated 240 orders for a total of 3,560 items, which were shipped in 1,200 boxes. What amount of shipping department costs should be allocated to these sales?

Answers

Answer:67,200

Explanation:

The shipping department cost will be $14200.

What is the cost?The term cost can be termed as the price of buying something or the amount that a company spends on making a product. It is the amount that is charged on something for the product. The incurred cost can have many variables and non-variable costs like purchasing cost, labor, wages, rent, maintenance, raw material, processing cost, packaging, and transportation.

In this Question, the International gems sell their product slots. The shipping department has been divided into three cost pools. The total shipping charges will be the addition of packaging and shipping, Final Inspection, and General operations.

So, the total shipping cost =5040 + 7120 + 2040 = 14200

Thus, the costs that should be allocated to the sales with respect to the shipping charges will be $14,200.

Learn more about cost, here:

https://brainly.com/question/15135554

#SPJ2

When using a credit card, a good fact to remember is that you are not paying on credit, you are actually paying on a _______.

Answers

Have a great day :)

Jack has just purchased his first surfboard from ABC Surf Shop (ABCSS), in Waikiki. While walking down Kuhio St., on his way home with his new surfboard, Jack hears someone call out his name. Jack immediately turns around and unbeknownst to Jack, Sarah is right behind him and gets hit in the face with Jack’s new surfboard. Sarah is rushed to the hospital emergency room with a concussion and a broken tooth. The cost of the emergency room visit was $1,200 and the dental work cost $4,000.

Answers

The issue that we are presented with here is that Jack has caused Sarah to be injured mistakenly because he was called from behind by her. The rule would be for him to take her to the clinic. The conclusion is that no party is at fault.

What is the summary of the situation that we have here?The summary on this situation is that an injury has occurred and the source of the injury is Jack. But unlike other situations that he may be held liable, the situation that led to the problem tells us that it was a mistake.

The issue

The issue is that Sarah has gotten injured through Jack after she called him from the back. He may have been startled by her.

The rule 'The rule that is to be applied here would be for Jack to effectively and immediately take her to the hospital so that she would get treated.

The conclusion

The conclusion that we can get from the scenario is that we cannot hold Jack liable for the injury. This was due to the fact that he did not act with the attempt to hurt her. He also did what was expected of him after the injury occurred.

Read more on injury here: https://brainly.com/question/19573072

#SPJ1

Complete question

IRAC Scenario

Jack has just purchased his first surfboard from ABC Surf Shop (ABCSS), in Waikiki. While walking down Kuhio St., on his way home with his new surfboard, Jack hears someone call out his name. Jack immediately turns around and unbeknownst to Jack, Sarah is right behind him and gets hit in the face with Jack’s new surfboard. Sarah is rushed to the hospital emergency room with a concussion and a broken tooth. The cost of the emergency room visit was $1,200 and the dental work cost $4,000.

Issue:

Rule:

Analysis:

Conclusion:

Objectives of pep stores

Answers

Answer:

The answer is below

Explanation:

PEP is a big store that is located in South Africa and other African countries.

Based on the PEP mission and vision and according to the company's website, the Objectives of PEP stores are:

1. To be the friendliest and most trusted retailer for this market.

2. To offer wanted products and services at the lowest possible prices

3. To meet changing consumer needs.

7. How does the quality of management relate to each of these causes of small business failure?

Answers

Answer:

Explanation:

The quality of management can have a significant impact on each of the causes of small business failure. Poor management can lead to financial mismanagement, which can cause a business to run out of cash and become insolvent. Ineffective management can also result in a lack of clear goals and direction, leading to a lack of focus and poor decision-making. Additionally, poor management can lead to problems with staffing and employee morale, which can negatively affect productivity and customer satisfaction.

On the other hand, good management practices can help a small business avoid these problems and increase the likelihood of success. Good management involves setting clear goals and making sound financial and strategic decisions, as well as effectively managing and motivating employees. By addressing these issues, a small business can improve its chances of avoiding failure and achieving long-term success.

Opportunity cost is the amount of increase or decrease in cost that would result from the best available alternative to the proposed use of cash or its equivalent.

a) true

b) false

Answers

The given statement is "False". A further explanation is provided below.

Whenever a decision had been made above another, the profit losses are determined as an Opportunity cost. This same notion is merely beneficial as a refresher or recalls to consider all acceptable possibilities well before a person decides.Opportunity costs aren't just an equity account method and hence are not included throughout a company's financial statements. This is simply a notion of the financial assessment.

Thus the above is the right answer.

Learn more about the opportunity cost here:

https://brainly.com/question/12121515

assess the way in which a business would benefit from a low interest rate 6 mark

Answers

Answer:

one way that a business would benefit from a low intrest rate is that there will be more customer because the borrowing rate is low

Explanation:

Char (61) took a $6,000 distribution from her Roth IRA. Twenty percent, or $1,200, is a distribution of earnings on her contributions. The remaining $4,800 is a distribution of her basis. Char established the account more than 20 years ago, when Roth IRAs first became available. How much of her distribution is taxable

Answers

Based on the information given, it should be noted that in this case, the amount from the distribution that's taxable will be $0.

In this case, it should be noted that the woman is older than 60 years. Also, she owned the accounts for more than five years. Therefore, in this case, the required condition for a tax free withdrawal has been met.

Hence, there'll be no distribution that's taxable. Therefore, based on the information given above, it can be deduced that the amount that's taxable will be $0.

Learn more about tax on:

https://brainly.com/question/932979

Question Content Area

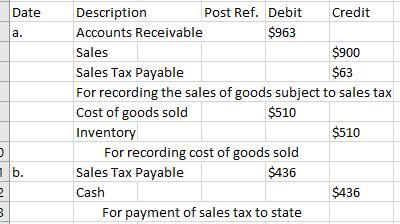

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

Identifying and Analyzing Financial Statement Effects of Dividends

The stockholders' equity of Hammel Company at December 31, 2016, is shown below.

5% preferred stock, $100 par value, 10,000 shares authorized; 6,000 shares issued and outstanding $600,000

Common stock, $5 par value, 200,000 shares authorized; 70,000 shares issued and outstanding 350,000

Paid-in capital in excess of par value—preferred stock 50,000

Paid-in capital in excess of par value—common stock 400,000

Retained earnings 747,000

Total stockholders' equity $2,147,000

The following transactions, among others, occurred during 2012:

Apr. 1 Declared and issued a 100% stock dividend on all outstanding shares of common stock. The market value of the stock was $11 per share.

Dec. 7 Declared and issued a 4% stock dividend on all outstanding shares of common stock. The market value of the stock was $14 per share.

Dec. 20 Declared and paid (1) the annual cash dividend on the preferred stock and (2) a cash dividend of 80 cents per common share.

Compute retained earnings for 2017 assuming that the company reports 2012 net income of $523,000.$________

Answers

Answer:

The Retained Earnings for 2017 will be $1,239,200.

Explanation:

The Retained Earnings shows Income attributable to Stockholders.

It is computed by adjusting the Opening Retained Earnings balance with the Income and Dividends Declared during the year as follows :

Opening Retained Earnings Balance $747,000

Add Net Income During the year $523,000

Less Dividends Declared :

Preferred Stock

Preferred Stock ( 4% × $100 × 6,000) ($24,000)

Preferred Stock ( 4% × $50,000) ($2,000)

Common Stock

Common Stock ( 80% × 6,000) ($4,800)

Opening Retained Earnings Balance $1,239,200

Conclusion :

The Retained Earnings for 2017 will be $1,239,200.

"You are a manager, and you are meeting with your boss to discuss your development plan. You have decided to benchmark Camp Bow Wow founder and “top dog” Heidi Genahl. Using her as a role model, you will identify the components of her leadership style that make it effective and adopt them to improve your own leadership ability."

Complete the following passage in the most appropriate way.

Sue Ryan says about Heidi that “her passion for this business comes out all over the place.” Sue says it’s “contagious” and got Sue excited about buying a franchise. Heidi ________1_________. To be like Heidi, you need to __________2_________.

Blank 1

A. is a leadership substitute

B. has a high-task, low-relationship style

C. is a charismatic leader

D. is a conformist

Blank 2

A. communicate that work is all about achieving goals

B. have a professional orientation and sufficient training

C. obey orders without question

D. have a compelling vision and communicate it properly

Answers

Answer:

BLANK 1. (B)

BLANK 2. (D)

When comparing and contrasting the income and economic protections of states with high union densities to states with low union densities a. States with high union densities have minimum wage levels almost 20% higher than the national average. b. States with low union densities have minimum wage levels almost 20% higher than the national average. c. States with low union densities have median incomes $10,000 higher than the national average.

Answers

Option (a), State minimum wages are roughly 20% higher than the national average in states with a strong union density.

What proportion of US civilian employment are unionized?According to statistics made public by the U.S. Bureau of Labor Statistics on Thursday, the rate of union membership decreased from 10.3% in 2021 to 10.1% in 2022. Nonetheless, the numbers show that the 14.3 million wage and salary workers who were union members last year climbed by 273,000, or 1.9%, from 2021.

Do persons who belong to unions make more or less money than those who do not? In that scenario, why then?Compared to non-members, union members are paid more and receive greater benefits. There is an average salary difference of 11.2% between union and non-union workers. Only 69% of non-union employees receive health insurance from their employment, compared to 96% of union employees.

Learn more about State minimum wages: https://brainly.com/question/28347730

#SPJ1

The complete question is:

When comparing and contrasting the income and economic protections of states with high union densities to states with low union densities

a. States with high union densities have minimum wage levels almost 20% higher than the national average.

b. States with low union densities have minimum wage levels almost 20% higher than the national average.

c. States with low union densities have median incomes $10,000 higher than the national average.

Burnside's has average accounts receivable of $33,700, average inventory of $54,200, sales of $364,200, and cost of goods sold of $193,400. How long does it take the firm to sell its inventory and collect payment on the sale?

Answers

It takes Burnside's approximately 102 days to sell its inventory and about 33.7 days to collect payment on the sale.

To calculate the inventory turnover and accounts receivable turnover, we can use the following formulas:

Inventory Turnover = Cost of Goods Sold / Average Inventory

Accounts Receivable Turnover = Sales / Average Accounts Receivable

Given the information provided:

Average Accounts Receivable = $33,700

Average Inventory = $54,200

Sales = $364,200

Cost of Goods Sold = $193,400

Calculating the turnover ratios:

Inventory Turnover = $193,400 / $54,200 = 3.57

Accounts Receivable Turnover = $364,200 / $33,700 = 10.81

The inventory turnover of 3.57 indicates that Burnside's sells its entire inventory approximately 3.57 times per year. This implies that, on average, it takes about 102 days (365 days divided by 3.57) for the firm to sell its inventory.

The accounts receivable turnover of 10.81 suggests that Burnside's collects payment on its sales approximately 10.81 times per year. This implies that, on average, it takes about 33.7 days (365 days divided by 10.81) for the firm to collect payment on the sale.

For more such questions on inventory visit:

https://brainly.com/question/29636800

#SPJ8

Data warehouses may contain many _____, subsets of a data warehouse that each deal with a single area of data.

Answers

Considering the nature of data analysis, Data warehouses may contain many data marts, subsets of a data warehouse that each deal with a single area of data.

What is Data Mart?A data mart is generally known to be part of data warehouses. It is used for quick analysis of business segments.

A data mart concentrates on a specific chain of business or department.

One of the advantages of a data mart is to ensure that little or no time is wasted while looking through a whole data warehouse.

Hence, in this case, it is concluded that the correct answer is Data Mart.

Learn more about Data Mart here: https://brainly.com/question/13989635

Which GPA does not appear on the transcript and therefore has to be calculated by the student for monitoring?

A. Term

B. Cumulative

C. Overall

Answers

Answer:

Explanation:

Cause GPA means the total grade point but CGPA means after completing the programme what is your cgpa.

what is gross income??

Answers

Answer:

the amount of money you make before all the taxes and deductions are made.

Explanation:

whay i said for the answer ^