Answers

Answer:

Annual depreciation (2nd year)= $16,000

Explanation:

Giving the following information:

Purchase price= $84,000

Salvage value= $20,000

Useful life= 4 years

To calculate the annual depreciation, we need to use the following formula:

Annual depreciation= (Purchase price - salvage value)/estimated life (years)

Annual depreciation= (84,000 - 20,000) / 4

Annual depreciation= $16,000

Related Questions

Which one of the following is NOT one of the major business functions or specialized tasks performed by business organizations and supported by information systems?

A. Sales and marketing

B. Human resources

C. Finance and accounting

D. Manufacturing and production

E. Collective bargaining

Answers

This a process which engages working people through union. They negotiated a contract with owner& the employers to get information details about the term of employment like pay, benefits, house leves,,health, safety policies.

Help to ensure balance work and personal relationship.

Sale HR financial and production are important business functions & supported heavily by information systems.

Collective bargaining is a negotiating process not core business function or specialised task.

How much increase in net worth (equity) would a market basis balance sheet show over a cost basis if Land was purchased for $1,000,000, is currently valued at $5,500,000 and capital gains taxes are 10%

Answers

Answer: $4,050,000

Explanation:

Increase in net worth shows the after tax gain that the person got after the land in question increased in value.

= (Current value - Purchase price) * ( 1 - tax rate)

= (5,500,000 - 1,000,000) * (1 - 10%)

= 4,500,000 * 0.90

= $4,050,000

why are relative prices important in the economy

Answers

Answer:

Relative-price changes, like inflation, can cause price pressure in an economy. Relative-price changes are not a monetary phenomenon. They arise in market economies as individual prices adjust to the ebb and flow of the supply and demand for various goods. Relative-price movements convey important information about the scarcity of particular goods and services. A rising relative price indicates that demand is outstripping supply (or that supply is falling behind demand), while a falling relative price denotes just the opposite. A rising relative price induces consumers to conserve on the good in question and to look for substitutes. A rising relative price also, by increasing profit opportunities, entices producers to bring more of the good in question to market.

In this way, relative-price changes—no matter how uncomfortable they are for consumers or producers—transmit vital information necessary for the efficient allocation of resources throughout any market economy. Inflation, by contrast, contributes no information useful to our consumption, production, or labor choices. If anything, inflation can temporarily distort vital relative-price signals, leading people to make unsound economic choices. It can even cause people to shift their time and resources away from activities that foster production and long-term economic growth to activities intended to protect their wealth rather than expand it.

Use the "Advanced Version for this activity

D Question 1

Initial investment-$250

Future Value with 5% interest rate

Answers

To calculate the future value of an initial investment of $250 with a 5% interest rate, we can use the formula for compound interest:

Future Value = Initial Investment * (1 + Interest Rate)^n

Where:

Initial Investment = $250

Interest Rate = 5% = 0.05

n = Number of periods

Let's assume we want to calculate the future value after 3 years:

Future Value = $250 * (1 + 0.05)^3

Calculating:

Future Value = $250 * (1.05)^3

= $250 * 1.157625

= $289.41 (rounded to two decimal places)

Therefore, the future value of an initial investment of $250 with a 5% interest rate after 3 years is approximately $289.41.

which of the following is a step in the marketing process

Answers

customer needs and want

b) Designing A customer-Driven Marketing strategy

c) Build profitable relationships

d) capturing value from customers

During 2012, Walker Corporation acquired 500 shares of Wychek stock at $30 per share. Walker Corporation accounted for the stock as available-for-sale securities. All declines in market value are considered to be temporary. The market price per share of Wychek’s stock as of December 31, 2012 and 2013, is $22.50 and $37.50, respectively. Given this information, the correct adjusting entry by walker at December 31, 2013, would include a credit to

A.Market Adjustment – Available-for-Sale Securities of $3,750

B.Unrealized Increase in Value of Available-for-Sale Securities – Equity of $7,500

C.Market Adjustment – Available-for-Sale Securities of $7,500

D.Unrealized Increase in Value of Available-for-Sale Securities – Equity of $3,750

Answers

Answer: B.Unrealized Increase in Value of Available-for-Sale Securities Equity of $7,500

Explanation:

Walker acquired the 500 shares at a price of $30 in 2012. At the end of 2012 however, the shares were worth $22.50.

At the end of 2013, it is stated that the shares are now worth $37.50 meaning they increased in value.

The value of the increase is therefore the difference between the most recent previous price and the new price,

= 500 shares * ( 37.50 - 22.50)

= $7,500

Available for Sale Securities Account should therefore see an increase of $7,500 because of the increase in price from the end of 2012 to the end of 2013.

It is worthy of note that at the end of 2012, the account decreased by the difference between the purchase price of $30 and the end of 2012 price of $22.50. This is why at the end of 2013, the price used as the previous price was $22.50.

Which of the following is a disadvantage of using nominal interest rate to compare investment options?

(1 Point)

It doesn't account for inflation

It doesn't account for compounding

It doesn't account for credit risk

It doesn't account for liquidity risk

Answers

The disadvantage of using nominal interest rate to compare investment options is that it doesn't account for inflation.The correct option is A.

The overall rise in prices of goods and services in an economy over time is referred to as inflation. It is a sustained rise in the average level of prices, leading to a decrease in the purchasing power of money.

Inflation occurs when there is an imbalance between the supply of money and the available goods and services in the economy. When the supply of money exceeds the available goods and services, prices tend to rise.

Thus, the ideal selection is option A.

Learn more about inflation here:

https://brainly.com/question/26644463

#SPJ1

What should you do to streamline the purchasing process once the customer approves an estimate?

Answers

You should copy it to a purchase order.

I hope this helps!!!

As a bank loan officer, you are considering a loan application by Endurance Sporting Goods. The company has provided you with the following information:

Cash $ 25,000

Account Receivable $45,000

Inventory $140,000

Fixed Assets $190,000

Current Liabilities $70,000

Long-Term Liabilities $90,000

Endurance Sporting Goods’ debt to owners' equity ratio (rounded to the nearest tenth of a percent) is

Answers

Endurance Sporting Goods’ debt to owners' equity ratio is 66.7%.

First step is to calculate the Owner's Equity

Owner's Equity=Total Assets - Total Liabilities

Where:

Total Assets =$25,000 + $45,000 + $140,000 + $190,000

Total Assets = $400,000

Total Liabilities =$70,000 + $90,000

Total Liabilities=$160,000

Let plug in the formula

Owner's Equity=$400,000-$160,000

Owner's Equity=$240,000

Second step is to calculate debt to owners equity ratio using this formula

Debt to owners equity ratio= Debt (total Liabilities)/Owner's Equity

Let plug in the formula

Debt to owners equity ratio = $160,000/$240,000

Debt to owners equity ratio = 0.667×100

Debt to owners equity ratio= 66.7%

Inconclusion Endurance Sporting Goods’ debt to owners' equity ratio is 66.7%.

Learn more about debt to owners' equity ratio here:https://brainly.com/question/25847981

The ________ measures the return on owners' (both preferred and common stockholders) investment in the firm.

A) net profit margin

B) price/earnings ratio

C) return on equity

D) return on total assets

Answers

Answer:

C) return on equity

Explanation:

The return on equity determines the financial performance of the company. It could be calculated by dividing the net income from the owners equity as according to the accounting equation, the owners equity could be find out by deducting the liabilities from the assets

So here the equity could be of both types i.e. common and preferred

Therefore the option c is correct

Identify four factors of production needed by Baker’s to produce bread and cookies.

Answers

In batch production, a set of things are finished through each stage of the production process one at a time. Making bread at a bakery is a nice illustration of batch manufacturing.

What are the four 4 factors of production What is their relationship?Inputs utilized in the creation of goods or services to generate a profit are referred to as factors of production in economics. These comprise any material required for the production of a good or service. Land, labor, capital, and entrepreneurship are the components of production.

The elements used to make a cake, such as flour and sugar, all came from crops, which are analogous to the factors of production (land). Even the chickens that laid the eggs consumed grains or corn that had been cultivated in the soil. You put forth the time and effort to combine the elements (labor).

Learn more about Factors of Production here:

https://brainly.com/question/988852

#SPJ1

What are the various product line decision, and when do marketing managers make each of these decisions? What is the meaning of product mix, width, depth, and length

Answers

Answer:

Product mix decisions arise as soon as an organization has several product lines. But what is ... Each of these product lines, in turn, consists of several sub-lines.

Explanation:

A reporting relationship in which an employee receives orders from, and reports to only one supervisor is known as:

Answers

Answer:

According to the concept of unity of command, each level of the organizational hierarchy has only one supervisor who is responsible for each employee. This holds true even if a collection of individuals leads the organization's top. Consider being the CEO of a Silicon Valley-based technology company as an illustration. While the board of directors of your company oversees policy-making and strategic planning, you solely report to the chairman of the board in accordance with the unity of command principle. however, have a supervisor for your unit who reports to her department manager. The vice president of operations, who reports to the CEO, is the department manager's superior. The board of directors' chairman is the CEO's subordinate.

Answer:

unity of command

Explanation:

Being accountable and answerable to more than one supervisor is never liked by the employees. Unity of Command is the one business management theory that resolves this issue.

According to the Principle of Unity of Command, there shouldn’t be a group of supervisors for a single subordinate or a single team working for a company.

For example, the HR team of a company will have just one supervising head instead of two or three to have an orderly set up in the work atmosphere. With the help of the Unity of Command principle, there is a proper hierarchy that is set in the company.

Using the following information, prepare a bank reconciliation for Oriole Company for July 31, 2022. a. The bank statement balance is $3,760. b. The cash account balance is $4,000. c. Outstanding checks totaled $1,450. d. Deposits in transit are $1,600. e. The bank service charge is $63. f. A check for $85 for supplies was recorded as $58 in the ledger.

Answers

Answer:

See photo. I am a professional so my format may be different than what school tells you. Hopefully you can use this information.

Explanation:

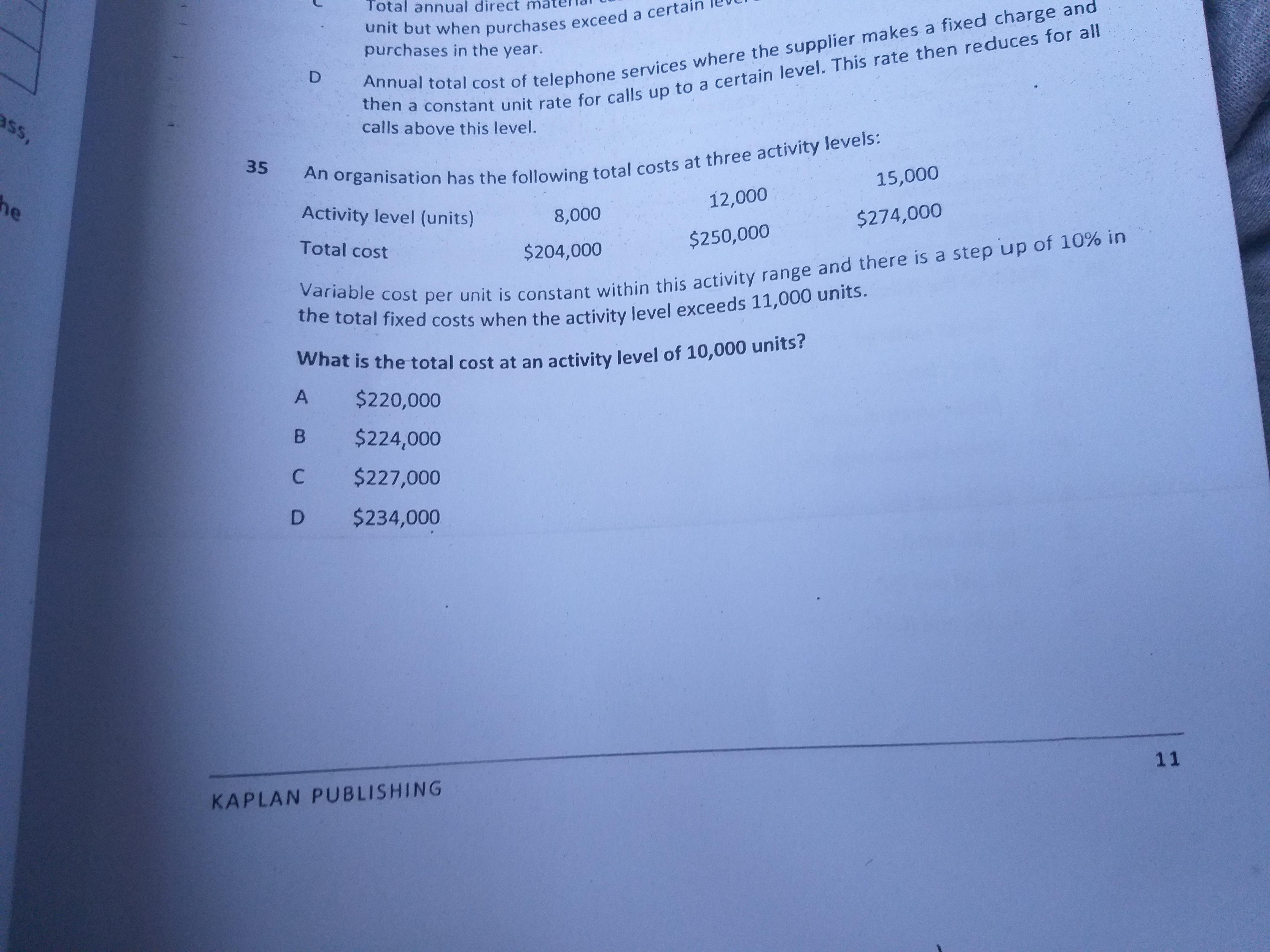

variable cost per unit is constant within activity range and there is a step up of 10% in the total fixed costs when the activity level exceeds 11000 units?

Answers

A variable cost is one whose price varies with volume. Raw materials, piece-rate labor, production supplies, commissions, shipping expenses, packing costs, and credit card fees are a few examples of variable costs. The "Cost of Goods Sold" is the name given to the variable costs of production in some accounting statements.

Fixed costs are expenses that remain constant regardless of whether sales or production volumes rise or fall. This is so because they are not involved in the actual process of producing a good or providing a service. Fixed costs are therefore regarded as indirect costs.Examples of fixed costs are rent and lease costs, salaries, utility bills, insurance, and loan repayments.

to know more about variable cost visit

https://brainly.com/question/27853679?

#SPJ1

a unique individual who has the courage to under take the risk associated with creating, organizing and owning business

Answers

Answer:

The description above defines an entrepreneur.

Explanation:

According to traditional economics, there are at least four-factor namely:

LandLabourCapitalEntrepreneurshipMore recent schools of thought have added information and technology that that list.

The entrepreneur still remains a critical part of the list given that it is responsible for putting together the other factors in such a way that value is given and received at the least cost possible.

Cheers

Point B on the graph represents which phase of the business cycle?

Answers

Point B on the graph represents Trough phase of the business cycle.

What is Trough phase in business cycle?A trough, in economic terms, can refer to a stage in the business cycle where activity is bottoming, or where prices are bottoming, before a rise. The business cycle is the upward and downward movement of gross domestic product (GDP) and consists of recessions and expansions that end in peaks and troughs.

A trough is an elongated area of relatively low pressure extending from the center of a region of low pressure. Air in a high pressure area compresses and warms as it descends. This warming inhibits the formation of clouds, meaning the sky is normally sunny in high-pressure areas. But haze and fog still might form.

A peak marks a cyclical high point in a time series, although there may be higher points in the time series' history. A trough marks a cyclical low point in a time series, although there may be lower points in the time series' history. A contraction in a time series is the period of decline from a peak to a trough.

To learn more about trough visit:

https://brainly.com/question/13657481

#SPJ9

Which factor would influence the premiums of health insurance?

Building size

Deductible

Elimination period

Profession

Answers

Answer:

Deductible

Explanation

The correct option is B. Plan category, the plan covers dependents, and deductibility is the factor that influences the premiums of health insurance.

What is Health Insurance?Medical and health-related costs are covered by a specific type of insurance called health insurance. Routine care, emergency care, and treatment for long-term illnesses are all partially or fully covered by health insurance.

Thus, there are many other factors that influence the health insurance premiums such as age, smoking status, region, type of plan, and if dependents are covered by the policy.

Learn more about Health Insurance here:

https://brainly.com/question/27356829

#SPJ2

At January 1, 2019, the Accrued Warranty Payable is . During 2019, the company recorded Warranty Expense of . During 2019, the company replaced defective products in accordance with product warranties at a cost of . What is the Accrued Warranty Payable at December 31, 2019?

Answers

Answer: A.$8,800

Explanation:

The Accrued Warranty Payable Balance for the year ending December 2019 will take into account the Warranty expenses that were old less the warranty expenses that have been paid for already with the formula;

= Opening Accrued Warranty payable + Warranty Expense recorded for the Year - Warranty Expenses Paid in the year

= 1,800 + 19,400 - 12,400

= $8,800

Answer:

jus 2 ez pz lemon squeezey ppppppp

Explanation:

Chris purchases a living room furniture set for $4,345 from Halloran Gallery. She has a one-year, no interest, no money down, deferred payment plan. She does have to make a $15 monthly payment for the first 11 months. b. How much must Chris pay in the last month of this plan

Answers

Answer: $4180

Explanation:

From the question, we are told that Chris purchases a living room furniture set for $4,345 and has a one-year, no interest, no money down, deferred payment plan. We are further told that She he made a $15 monthly payment for the first 11 months.

The total amount paid for the first 11 months will be:

= $15 × 11

= $165

Since he has to pay the total amount for 12 months, the amount that Chris will pay in the last month of this plan will be:

= $4345 - $165

= $4180

which 2 statements regarding intuit approved quickbooks online apps are true? Select all that apply 1. It is recommended that the master administrator of the quickbooks company complete the setup. 2.You can sign up for quickbooks payments fro the dashboard in quickbooks online. 3. You can connect an existing qucibooks payments,Go payment or intiut merchant services account 4.it is a best practice for the proadvisor to complete and sign the quickbooks paymment agreement on behalf of client 5. you mus record the receive payment for each invoice paid using the pay on button.

Answers

Answer:

1. It is recommended that the master administrator of the quick-books company complete the setup.

3. You can connect an existing quick-books payments, Go payment or intuit merchant services account.

Explanation:

Quickbook is an accounting software which help in recording and processing a financial transaction. This software is best suited for small to medium sized organisations. Master administrator has all the access rights of a company administrator. Master administrator is the one who initially creates the quick book company file and he is then assigned as Master administrator.

The Quickbook is accounting software that helps in recording and processing financial transactions that are in monetary terms. This software is easy to access and therefore best for small and medium-sized business firms.

The 2 statements that are true about the intuit approach in the app are as follows:

1. It is recommended that the master administrator of the quick-books company complete the setup.

3. You can connect an existing quick-books payment, Go payment, or intuit merchant services account.

Under the Quickbook online apps, there is a Master administrator that gives access to all the rights of the business to the operating administrator. The master administrator is known for making or creating the initial book in the Quickbooks company file.

To know more about Quickbook, refer to the link:

https://brainly.com/question/17490243

A company's interest expense is $20,000. Its income before interest expense and income taxes is $140,000. Its net income is $58,800. The company's times interest earned ratio equals:_________ a) 0.42 b) 700 c) 2.38 d) 0.143 e) 0.34

Answers

Answer:

7

Explanation:

The company's times interest ratio is calculated as;

= Its income before interest expense and any income taxes ÷ Interest expense

= $140,000 ÷ $20,000

= 7

Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company’s stock currently is valued at $45.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $36.00 per share. Larry worries about the value of his investment.

a. Larry's current investment in the company is __________If the company issues new shares and Larry makes no additional purchase, Larry's investment will be worth _____________

b. This scenario is an example of __________ . Larry could be protected if the firm's corporate charter includes a provision.

c. If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will become ___________

Answers

Answer and Explanation:

a. The current investment is

= 2,000 × $45

= $90,000

The investment should be worth of

= (20000 × 45)+ (5000 × 36)

= ($900,000 + $180,000)

= $1,080,000

Now price per share is

= $1.080.000 ÷ 25,000

= 43.2

so, new value of larry shares is

= 43.2 × 2000

= $86,400

b. Dilution and preemptive right

c The investment value should be

= 90,000 + 500 × 36

= 90,000 + 18,000

= 108,000

Question 1 of 5

What type of goal can help you be prepared for unexpected costs, such as

car repairs?

Long-term financial goal

An emergency fund

Retirement savings

Short-term financial goal

Subsi

Continue

Answers

A goal that can help you to be prepared when there are unexpected costs such as car repairs is An emergency fund.

How can you be prepared for unexpected costs?In order to be prepared for unexpected costs, the best thing to do is to have an emergency fund where you are able to save for when you may have to spend money that you are not prepared for.

The emergency fund would be best placed into an account that can earn interest but at the same time can be eaisly accessible. This was you can earn more money while saving for emergencies, and also be able to use the money for those unexpected costs.

Find out more on emergency funds at https://brainly.com/question/13420184

#SPJ1

This incentive contract is based on a target price of $260,000 withexpected costs of $240,000 and target incentive of $5,000.Thecontract specifies a share ratio of 80/20. If the actual cost is $249,000, what is the seller's final fee?A.$5,000,B.$13,800,C.$11,000,D.$7,200

Answers

The seller's final fee is $7,200. which is option D. based on the incentive contract.

The seller's final fee can be calculated by subtracting the target cost from the actual cost and multiplying it by the share ratio.

First, let's calculate the difference between the actual cost and the target cost:

Actual cost - Target cost = $249,000 - $240,000 = $9,000

Next, we multiply the difference by the share ratio:

$9,000 * (80/100) = $7,200

Therefore, the seller's final fee is $7,200.

Learn more about incentive from this link:

brainly.com/question/964887

#SPJ11

Question 2 (1 point)

Alise works for a life insurance company as a claims agent. She processes insurance

payments for the families of recently deceased persons. What quality might Alise

find helpful in her career?

being artistic and enjoying performing

Opreferring to work with wildlife

liking to create things with her hands

being kind and a good listener

Answers

If the policyholder makes the requisite premium payments, the insurer is obligated to pay the death benefit upon the insured's passing. Premium amounts are influenced, in part, by the likelihood that the insured will pass away before the policy's death benefit is paid by the insurer.

Why do life insurance providers inquire as to whether you have other insurance?Your final life insurance prices will be based on these since the insurers want to know how dangerous you are to insure.

If everyone passes away, how do life insurance companies make money?When a policyholder passes away, the company invests these premiums and utilizes the proceeds to pay claims to the beneficiaries of the policy. The interest and dividends received on the investments made with premiums generate income for the company as well.

To Know more about policyholder

https://brainly.com/question/14521673

#SPJ1

what is the background of the unilever company?

Answers

Answer:

Ueliever somthing i forgot

Explanation:

The affairs of the business is managed by head of the family known as karta in ?

Answers

Answer:

The affairs of business are managed by the head of the family, who is known as the Karta. In the entire Hindu joint family, the karta occupies a very important position. Karta is the eldest member of the family.

please mark me as brainliest

Burns has a capital balance of $98,000 after adjusting assets to fair market value. Van Ness contributed $56,000 to receive a 45% interest in a new partnership with Burns. Determine the amount and recipient of the partner bonus.

Answers

Answer: Van Ness, $13,300

Explanation:

From the question, we are told that Burns has a capital balance of $98,000 after adjusting assets to fair market value and that Van Ness contributed $56,000 to receive a 45% interest in a new partnership with Burns. The calculation goes thus :

Equity of Burns = $98,000

Van Ness contribution = $56,000

Total equity = $98,000 + $56,000

= $154,000

Van Ness equity interest = 45%

Van Ness equity after admission will now be:

= 45% × $154,000

= 0.45 × $154,000

= $69,300

The recipient of the partner bonus is Van Ness end the amount will be his equity after admission minus his contribution. This will be:

= $69,300 - $56,000

= $13,300

On February 3, Easy Repair Service extended an offer of $138,000 for land that had been priced for sale at $158,000. On February 28, Easy Repair Service accepted the seller's counteroffer of $150,000. On October 23, the land was assessed at a value of $225,000 for property tax purposes. On January 15 of the next year, Easy Repair Service was offered $240,000 for the land by a national retail chain. At what value should the land be recorded in Easy Repair Service's records?

Answers

The value that the land should be recorded at in Easy Repair Service's records as a result of the land being priced for sale and being assessed for tax purposes, is the original cost of $150, 000.

What should the land be recorded at?When it comes to recording the value of land, the Cost concept principle applies which is that the land should be recorded at the original cost. This is because land is a fixed asset that does not lose value and might instead increase in value. To avoid confusion, land is then recorded at its original cost.

This original cost is the price that a company or individual acquired the land from the previous owner. In this case, Easy Repair Service accepted a seller offer of $150, 000. This is therefore the value of the land and what the land should be recorded at in Easy Repair Service's records.

Find out more on recording land value at https://brainly.com/question/24196065

#SPJ1